Most real estate investors and financial/tax advisors see a 1031 exchange as nothing more than a way to trade a duplex and get a triplex without paying tax.

They are mistaken. Every day, we help investors use exchanges to realize their economic and tax-savings dreams. On our case studies page, you will find examples of how that is accomplished. In our 1031 knowledge base, you will find a series of articles that will help you understand important terms used in 1031 exchanges.

Our Vision

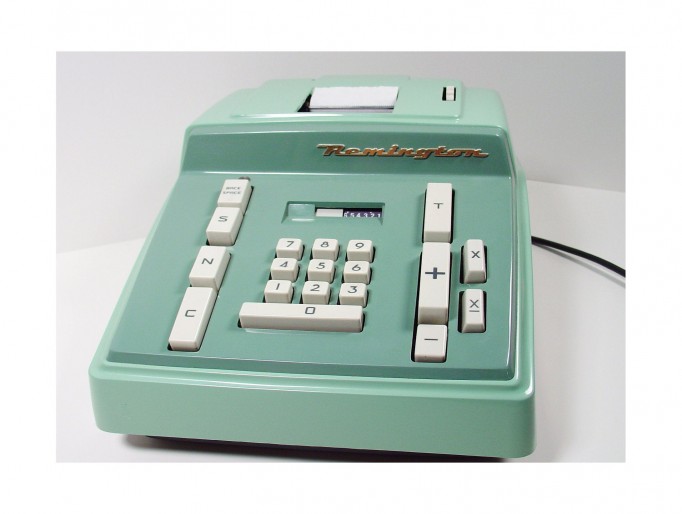

Continuing a Legacy

Yesterday, I was on a phone call with a new client who had been having their returns prepared by a large, well-known accounting firm with over 1,500 offices and 80,000 employees worldwide. With all that firepower, you would think the returns would be flawless. Not so. All I looked at were the depreciation schedules. There were several properties where the depreciation was much less than it could have been. I didn’t add them up, but the client could have been claiming at least $15k more depreciation. In another area, there were at least $50,000 of depreciation deductions that could have been written off. Not every return preparer is wrong, and even in the above case, a weak argument could be made for doing things the way this company did them. Still, our mission is to use every legal means to make sure that your money stays in your pocket rather than going to the IRS.

Our History

A Tradition of Helping Real Estate Investors

The first Simmons tax office opened in 1953. We started out not just working with real estate investors, but also creating real estate investors. In the 50's and 60's, federal tax rates were as high as 70%. Real estate was the only investment a person could make where they didn’t have to give most of their profit to the government. We spent a lot of the first 25 years of our existence showing people the advantages of investing in real estate. Time changes everything. These days, we spend our time helping real estate investors get cash from their equity or increase cash flow without paying a lot of taxes. Personally, I have spent most of the last 50 years helping real estate investors while building my own little portfolio of rentals. It’s been an amazing ride.

Planning An Exchange

Experience Makes All the Difference When Planning an Exchange

One area we excel in is planning for a 1031 exchange. As a real estate investor, you likely know that most investors don’t sell their properties often. I owned my first rental for 30 years before I sold. As a result, most tax preparers don’t do much with sales or exchanges. If a preparer has 150 real estate investors, which is a lot for a single preparer, he might see an exchange once every ten years. In contrast, our staff works on more than one exchange every day. Because of the clientele we focus on, we are constantly helping plan exchanges. As you explore this website, you will see what a difference that makes!